Budget 2023-2024 Response

The St Peters Residents Association (SPRA) would like to thank the City of Norwood Payneham & St Peters for the opportunity to comment on the 2023-2024 Annual Business Plan & Budget. We also appreciated the opportunity to be able to speak to the Plan and ask questions on Wednesday evening. This submission is intended to supplement those verbal comments.

SPRA's response is available as a pdf for printing.

Payneham Memorial Swimming Centre Redevelopment.

The Association has serious concerns regarding the cost of the redevelopment of the Payneham Swimming Centre, and the financial risk that this puts upon the Council’s long-term financial viability.

The Budget is based upon a project cost of $24m, however, as pointed out in the Staff Report presented to Council’s Audit and Risk Committee at its 15th May meeting, the current estimated project cost is now approximately $32.6m, and that tenders could be up to $35m.

It would have seemed prudent to have made provision in the budget for these higher costs rather than using the old figure.

It should be noted that the Prudential Report presented to the Audit & Risk Committee used the $32.6m figure and factored in an interest rate of 5.8%.

We fail to understand why these figures were not used in the preparation of the budget.

SPRA urges Elected Members to read the agenda for the 15th May 2023 Audit & Risk Committee meeting, and in particular the UHY Haines Norton Prudential Report on the project provided in Attachment D.

The Project Risk Assessment (page D28) shows that final tendered price is “Almost Certain” to be over budget ($24m) and that the Impact Level is “Major” resulting in the Inherent Financial Risk being “Extreme 4”. We would argue however that this Impact Level should be “Catastrophic” given that the metric is “Over $1millon” (p D26), resulting in the Inherent Financial Risk being “Extreme 1”.

Council requested a State Government grant of $10m for the project but received only $5.6m. Further, the delay in project commencement means the Council is in breach of the Grant Deed. An extension was requested in September 2022 (Att E Report to 15th May 2023 Audit & Risk Committee), but we assume a response has not been received.

Council must reassess the viability of this project and the long-term risk it involves.

Long Term Financial Plan 2021 – 2031

The Budget is based upon Council’s Long Term Financial Plan 2021-2031 (LTFP) and the revisions of 7 November 2022.

The LTFP was based on the following assumptions (LTFP pp23-25): -

- CPI increases of 2%.

- Rate increase 2.6% plus additional 1.5% for capital works - total 4.1%

- Wage increases 2.0%pa.

- Construction costs increase 2.3%pa.

- Interest on new borrowings 2.4 – 2.75%

- Depreciation 1% to 3% depending on the class of the asset.

The Pool Prudential Report notes the following (pp D13-D14): -

The Business Case includes a Profit and Loss and Cash Flow projection for the period ending 30 June 2031. The Business Case was prepared in January 2021 and included a number of assumptions. The following assumptions are affected by the changed economic situation as detailed below:

- Business Case inflation at 2.0%. The (Local Government Price Index) for Sept 2022 was 6.7%, and the CPI for Adelaide for Sept 2022 was 8.4%. Inflation is expected to be higher than 2% for the next few years.

- Business Case borrowing rate at 2.5%. Current Cash Advance Debenture rates with LGFA is 5.80% (2nd May 2023). As well as increased interest rates, increased capital costs will result in higher finance costs than forecast.

- That grant funding is received of 50% or $10m of the estimated project costs. Actual Grant funding confirmed is $5.6m.

- Depreciation is based on the capital expenditure of $24m. The final capital costs will only be known once tenders are received. There is a significant trend in cost escalation at the moment brought about by a shortage of contractors and materials that will impact the final cost. Higher capital costs will increase depreciation costs.

- We note that the Employee expense line does not increase by inflation from 2029 to 2031

All these assumptions need revision in the current financial climate.

The escalation in construction costs look like being well above headline CPI with supply and labour availability issues being compounded by increased union militancy, at least for major projects. Project costs will almost certainly be well above the projections as the LTFP is based on 2020/2021 data. Thus, if projects proceed at the pace in the plan, borrowings & depreciation can be expected to be much higher than indicated in the LTFP, and interest on those borrowings compounded by much higher interest rates on the increased borrowings.

As well as the Swimming Centre, the Council has other major capital works ahead including The Parade & George Street Streetscapes (LTFP $30m).

While these challenges may be manageable, an urgent update to the LTFP would appear necessary as a matter of some urgency.

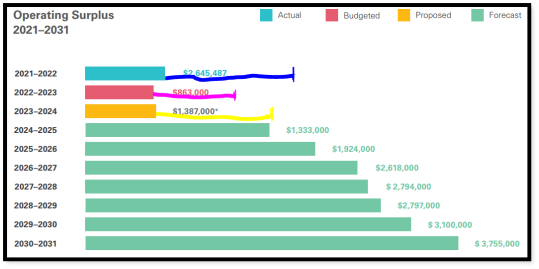

Operating Surplus

There appear to be serious challenges ahead. The Operating Surplus appears to have resulted largely from grants being received ahead of actual capital expenditure and in delays to project timelines.

The Graph 2 on Page 48 appears to be incorrect.

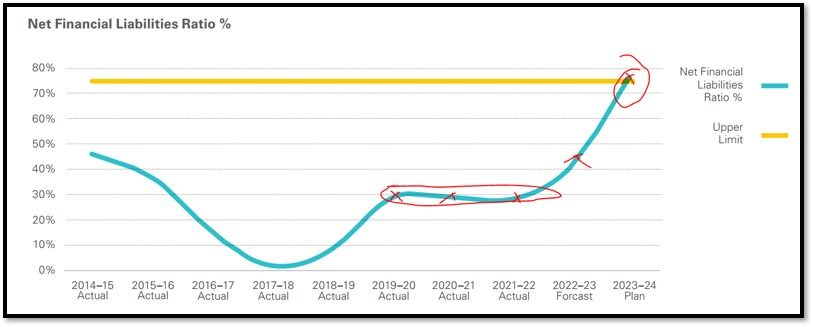

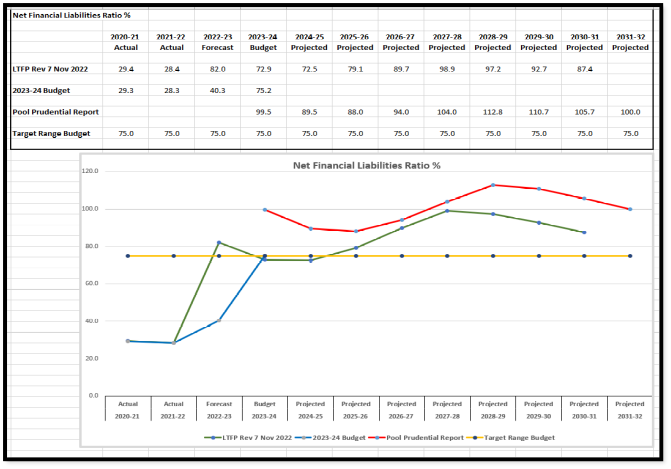

Net Financial Liability Ratio

The Association is concerned that the Net Financial Liability Ratio (NFLR) has increased considerably in this budget. For the period 2019 to 2022 the NFLR was about 30%. This increased to 40% in 2022-23 and in this budget, it is 75%. This represents a 150% increase on the 2019 – 2022 figure.

What is more alarming however is the figure proposed fails to take into account the NFLR figures that are used in the LTFP (Rev 7 May 2022) nor in the Payneham Pool Prudential Report. Both show the future borrowing needs for the pool and other capital works.

Rates

For St Peters, Joslin, College Park, Maylands and Evandale residents it is probable that Residential Rates will rise more than the city average as a result of recent sales history in these areas. The rate increases could be towards, or even reach, the rate cap of 17%.

The mix between Residential and Business Rates is a complex issue, and we fear that the very steep increase in Business Rates may exacerbate the cost challenges facing some local businesses to the point that they are forced to relocate or close, to the detriment of residents who rely on those services.

Raising the Bar. Page 53

SPRA acknowledges that while the Raising the Bar events do form a worthwhile part in the City’s popular culture, we question why there needs to be a $38,000 Council contribution.

It appears that the figure is a subsidy or inducement to commercial operators to host events.

The expenditure raises several questions, including: -

- Does Council pay to hire rooms from the venues?

- Are speakers paid?

- Attendees pay an entry fee?

These operators should be paying Council for the privilege of hosting the events, as they attract extra patrons who then spend money for food and drink.

Food Secrets Ambassador Events. Page 53

The budget proposes expenditure of $40,000 to appoint “a highly acclaimed celebrity/influencer as the City’s Food Secrets Ambassador”.

Surely rate revenue could be better spent in ways other than to a “celebrity / influencer”.

Have lessons not been learned from recent Tourism SA Sam Smith debacle?

St Peters Child Care Centre Page 41

The St Peters Child Care Centre has a projected loss of $101k.

The Centre competes against other privately owned facilities in the council area and should be expected to operate profitably in its own right, or at least break even.

Parents using the Centre come from all over the metropolitan area, and are not restricted to NPSP residents, and as such they should not be subsidised by the community.

SPRA suggests that the Centre could be leased to a private operator, thereby ensuring future income for this Council-owned asset. It should however not be sold off considering its location adjacent to Linde Reserve, and Commonwealth funding constraints on the Centre’s establishment in the 1970s.

Purchase of Trailer Mounted Speed Radar and Data Collection Device Page 50

While the Business Plan fails to explain how this is to be used, we hope that it has revenue raising potential, and that it will assist in traffic and ‘rat-running’ issues.

Additional Resources for Regulatory Services Unit Page 55

The budget puts a cost of $13,000 against this item.

This amount will not cover the costs for the stated “Employment of an additional Compliance Officer, Parking, a General Compliance Officer and lease two additional vehicles”.

We assume that this amount is incorrect and should be $130,000, which has been reflected in the overall figures.

Conclusion

The St Peters Residents Association trusts that these comments will be considered in the finalisation of the 2023-2024 budget.